The Simple Side's Saturday Sendout: BLSH Call Printed Money | UNH Call Printed Money | AAPL Call Printed

Description

To Simple Side Shareholders — good morning! I am glad to have you join me for another Saturday Sendout. We are finally back on all podcasting platforms as well!

If you are new here or unfamiliar with our content, you can see the layout of everything below!

* SATURDAY [free]

* Market Commentary

* Weekly Picks Performance

* An Interesting Trade Idea *NEW*

* Total Portfolio Performance

* SATURDAY [paid]

* Our Weekly Picks

* Mergers & Acquisitions Picks

* Top Stock Picks

* Micro Cap Stock Picks

* Earnings & Options

**** Paying subscribers — I will be sending you an email about the plan forward since Double Finance is closing its doors. Be on the watch for an email this week**** I missed this last week as I was sick!

Next Weeks Updates

I am going to be changing the format of the newsletter next week. Instead of discussing the weekly picks, we are going to be focusing more on the long-term portfolios. Of course, we are going to keep the picks for everyone looking to keep trading weekly, but it is going to be much less of the newsletter.

The new format going forward will look similar to this:

* FREE

* Market Commentary & News

* Quick Insider Trade Updates

* Interesting Trade Ideas

* Portfolio Performance

* PAID

* Portfolio Holdings & News

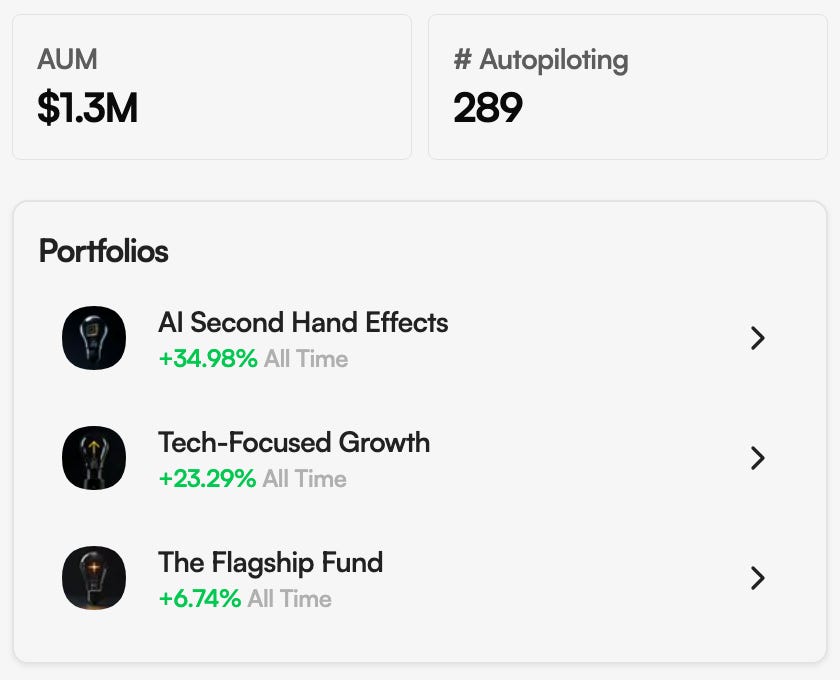

* Flagship Fund, AI-2nd Hand Effect, Tech-Focused Growth

* Portfolio Strategies, Updates & New Bets

* Our Weekly Picks

* Mergers & Acquisitions Picks

* Top Stock Picks

As a reminder, all of this will be accessible to you via copy trading. Remember that these portfolios ARE NOT GET RICH QUICK portfolios. I am focused on long-term market outperformance.

Anyone who is constantly promising +50% returns annually is lying. There is one man who is able to do that and his name is Jim Simmons. He is the most secretive man on the planet and refuses to divulge information about how he trades. Do not believe these “guaranteed +50% annual return” con artists.

There will be updates made to the paid subscriber spreadsheet as well, but I will likely update everyone on those when they are completed!

The Saturday Sendout (commentary)

Big picture

Stocks ground out fresh records mid-week and finished higher overall, paced by cooler-than-feared CPI, resilient earnings, and a bid into small caps and homebuilders. A hotter PPI print pared rate-cut odds a touch and nudged long yields higher into Friday.

* Weekly moves: S&P 500 +0.9%, Nasdaq +0.8%, Dow +1.7%, S&P Mid Cap 400 +1.6%, Russell 2000 +3.1%.

* Rate path: CPI in line (headline +0.2% m/m; core +0.3% m/m). PPI surprised to the upside (+0.9% m/m). Markets still lean toward a 25 bp cut in September, but the PPI print trimmed confidence.

* Yields: 2-yr ~3.76% (flat on week); 10-yr up to ~4.33% by Friday.

* Leadership: Healthcare, Consumer Discretionary, and small caps outperformed; mega-cap tech was mixed; homebuilders rallied.

Macro & policy

* Inflation: Headline CPI 2.7% y/y; core 3.1% y/y. PPI broad-based gains across stages of production.

* Growth pulse: Services PMI hovered near the expansion line; factory orders were soft ex-transportation slightly positive.

* Fed expectations: Cut odds remained elevated for September, with debate about follow-on moves into Q4.

Sector check

* Winners: Healthcare (helped by UNH, LLY momentum), Consumer Discretionary (retail, homebuilders), Materials.

* Laggards: Real Estate, parts of Energy, and selected Semis after mixed guides.

* Breadth: Equal-weight S&P and small caps outpaced the cap-weighted index on several sessions.

Day-by-day

Monday (8/11)

* Tape: Early strength faded; S&P -0.3%, Nasdaq -0.3%, Dow -0.5% as traders squared up ahead of CPI.

* Chips & trade: Nvidia/AMD reportedly accepted a 15% revenue remittance on China AI-chip sales in exchange for export licenses; semis wobbled.

* Capital moves: Ørsted plunged on a $9.4B rights issue to fully fund Sunrise Wind. Western Union agreed to buy Intermex (~$500M).

* Company flow: C3.ai cut outlook and reorganized sales; SoftBank weighed a PayPay U.S. IPO; Avantor drew activist pressure; RadNet beat; GSK won FDA priority review (Blujepa).

Tuesday (8/12)

* Tape: CPI-relief rally to new highs—S&P +1.1%, Nasdaq +1.3%, Dow +1.1%; small caps ripped (R2K +3.0%).

* Rates: September cut odds jumped; curve twisted with 2-yr down, 10-yr up.

* Corporate: Gildan neared a Hanesbrands deal; Pfizer/Astellas’ Padcev+Keytruda hit key endpoints in bladder cancer; Bakkt pivoted to crypto infrastructure; Kodak outlined pension asset reversion and U.S. pharma capacity plans.

Wednesday (8/13)

* Tape: More highs with rotation—S&P +0.3%, Dow +1.0%, Nasdaq +0.1%; equal-weight and small caps led.

* Deals/defense: Advent to acquire Sapiens ($2.5B). Elbit won a ~$1.6B European contract. Exxon inked exploration off Trinidad & Tobago.

* Other movers: Hudbay sold 30% of Copper World to Mitsubishi; TSMC to phase out 6-inch wafers over two years.

Thursday (8/14)

* Tape: PPI surprise cooled risk appetite; indices mixed (S&P +0.03%, Nasdaq -0.07%, Dow -0.02%); small/mid caps fell ~1.2%.

* AI & infra: Cisco set FY26 revenue target $59–60B on AI orders >$2B in FY25; Foxconn guided AI-server revenue +170% y/y for Q3.

* Energy/industrials: EPD managed a Houston terminal leak; Halliburton won a North Sea stimulation pact with COP.

* Bankruptcy: TPI Composites entered Chapter 11 with DIP financing.

Friday (8/15)

* Tape: Mixed finish—S&P -0.29%, Nasdaq -0.51%, Dow +0.08%; yields drifted up; VIX stayed contained.

* Earnings & guides: Applied Materials posted record Q3 but guided Q4 lower on China uncertainty; still sees FY25 growth. Oracle expanded Google Cloud tie-up to bring Gemini models to OCI. Accenture bought CyberCX to scale APAC cyber.

* Standouts: UnitedHealth jumped after Berkshire disclosed a new stake. Precigen surged on FDA approval of Papzimeos for RRP. Nu Holdings delivered strong growth.

* Autos/EVs: XPeng and Volkswagen accelerated joint E/E architecture milestones in China.

Notable deal & capital flow

* M&A / stakes: Western Union → Intermex; Advent → Sapiens; Gildan → Hanesbrands (agreement announced later in week); Centrica/ECP → Grain LNG terminal; Alcon → STAAR Surgical (earlier this week’s flow).

* Programs & financing: Uber authorized $20B in buybacks; Coinbase priced $2.6B converts; Meta secured $29B project financing for a Louisiana AI campus.

* Restructurings: TPI Composites Ch.11; C3.ai leadership and go-to-market changes.

Single-stock highlights

* Chips/AI: Nvidia/AMD China-license structure weighed on near-term sentiment; TSMC July sales +26% y/y earlier in the month; Coherent slumped on datacom share concerns.

* Healthcare: UNH rallied on Berkshire stake; GSK priority review; Pfizer/Astellas oncology data positive; Precigen won FDA approval; Eli Lilly launched Mounjaro pen in India.

* Energy/commodities: Exxon expanded Caribbean exploration; OXY/COP advanced capital efficiency plans; gold eased late-week despite earlier strength.

* Retail/consumer: Homebuilders strong; selected e-commerce (JD.com, Vipshop) beat; Roblox fell on safety headlines.

“Guru” flow (selected)

* Berkshire opened UNH.

* Stan Druckenmiller added TSM; Louis Bacon added CCRN; Carl Icahn added CTRI.

* Multiple long-onlys rotated toward cyclicals (homebuilders, industrials) and added to semis on weakness.

The read-through

The market rewarded signs of disinflation without growth shock, and breadth improved as small caps and cyclicals caught a bid. A firmer PPI reminds that the Fed still needs comfort to cut, keeping rates-sensitive factors and high-multiple names twitchy around data drops. AI capex and semis remain the swing factor; healthcare leadership broadened the advance.

What I’m watching next

Housing data, retail sales, and the next round of Fed speaker cadence for confirmation of September cut odds.

Weekly Picks Performance

Our weekly picks are made in this newsletter (behind the paywall) every week. Now, nearly all of my conventional investing wisdom says that trading stocks weekly on “news” is a terrible idea. One particular quote comes to mind:

“Buy bad news, sell good news.”

Yet, we are doing the opposite! We are following good news & capitalizing on it weekly. Why does this work? Well, in a “normal” market, they don’t work; however, we are in a “dumb money” market (read about dumb money here).

The main idea is that a significant amoun